A practical example of how a bridging loan works when buying a new property.

Bridging Loan

Bridging Loan

Your selected lender will assume security over both properties and make loans against them until both the sale and purchase procedures are finished. Your house loan will often be charged as an interest-only loan during a bridging loan period. Numerous lenders have interest rates that are either somewhat higher than or equal to the normal variable rate.

Purchasing a new house prior to selling your current one can be accomplished with bridging home loans. In addition to being used to finance the building of a new home while you are still residing in your current residence, they are sometimes utilized to finance the acquisition of a new property while your current property is being sold.

Why Choose us ?

- Comprehensive Home Loan Solutions

- Personalized Loan Consultation

- Exceptional Customer Service

- Competitive Rates and Flexible Terms

Cost

of Work

With portability, you can move your existing loan from your previous property to your new one, saving a lot of money on the initial and recurring expenses of getting a new loan.

You won’t have to make any payments on the new loan while you sell your current residence if you have a capitalized interest bridging loan. Rather, a fresh loan is created to buy the new house and settle the debt using your current residence as collateral.

Connect with a Trusted Local Advisor

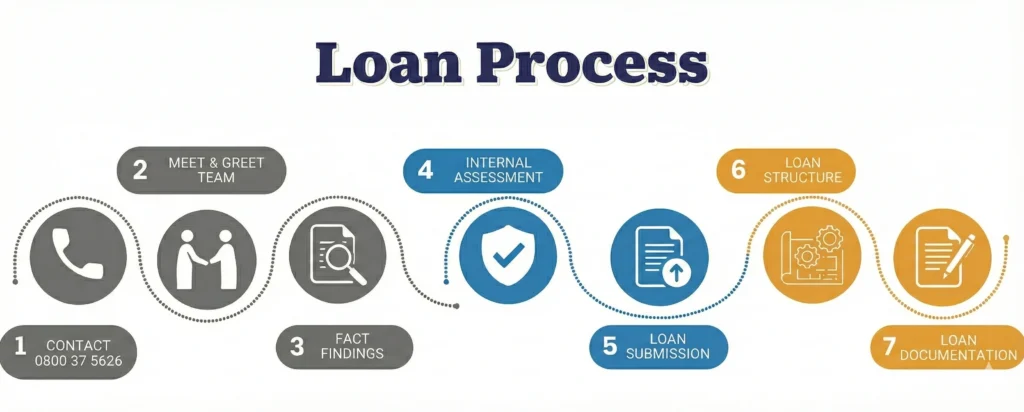

Ready to take the right step towards your loan journey?

Call expert

0800 DR LOAN (375 626)

Write email

info@betterloansgroup.com

Visit office

P. O. Box 67022

Mount Eden, Auckland,

1349

New Zealand